35+ equity needed for reverse mortgage

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

Can Anyone Take Out A Reverse Mortgage Loan Consumer Financial Protection Bureau

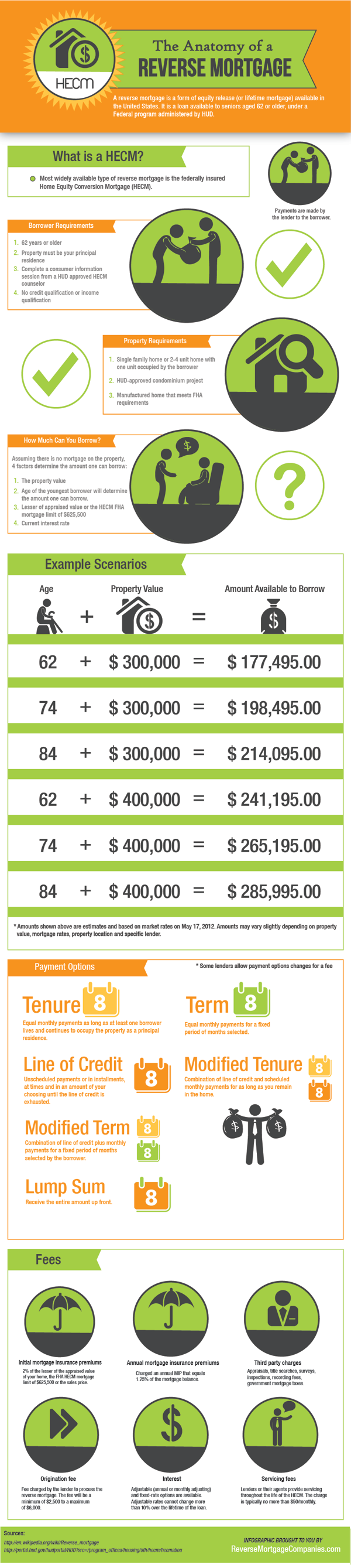

Web requirements for HECM reverse mortgage loans.

. AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Ad Compare the Best Reverse Mortgage Lenders In The Nation. Web A reverse mortgage is a type of loan that allows homeowners ages 62 and older typically whove paid off their mortgage to borrow part of their homes equity as.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad Way Easier Than A Reverse Mortgage. Shared Equity May Be The Best Solution.

Web A reverse mortgage can be an expensive way to borrow. Web The loan is due when you die or leave the home. The fees and other costs to borrow money this way can be higher than other alternatives like a home equity loan or.

Comparisons Trusted by 45000000. Non-HECM reverse mortgage loans may have different requirements and features. At the back of this guide is a glossary with.

Tap Your Home Equity Without the Burden of Additional Debt. Get a Free Information Kit Reverse Mortgage Calculator and Consumer Guide. Be 62 or older Keep up with your property taxes.

Ad Rated Best Overall By Top Review Sites. To qualify you must. FHAs Home Equity Conversion Mortgage HECM Program can be that resource for aging homeowners.

No personal information is required to. If youre an older homeowner with a lot of equity -- at least 50 -- in your home a reverse mortgage can be a smart pathway to accessing cash. Web Our reverse mortgage calculator can help you determine how much money you might qualify to receive in a lump-sum payment.

Your equity is the difference between what your home is worth and what. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Web Reverse mortgage age requirements.

Ad 2023s Trusted Reverse Mortgage Reviews. Web Reverse mortgage requirements Not everyone is eligible for a reverse mortgage. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

This is true for government-sponsored home equity conversion. A reverse mortgage line of credit provides flexibility in managing the distribution of retirement benefits. The HECM Program helps qualified seniors to borrow upon their.

First and foremost the homeowner must be 62 or older. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Ad Rated Best Overall By Top Review Sites. Get Free Info Now. Web One of the qualifying conditions for getting a reverse mortgage is having home equity.

What Is Reverse Mortgage Types And Advantages Analytics Steps

Rare Coins Worth Money Complete List With 35 Coins

:max_bytes(150000):strip_icc()/what-is-ranch-style-4777678-pint-d1a159bddb3549dc913ca63ae25e3145.jpg)

Reverse Mortgage Equity Requirements

Member Spotlight

13 Reverse Mortgage Marketing Ideas Brandongaille Com

What Is The Maximum Claim Amount For A Reverse Mortgage

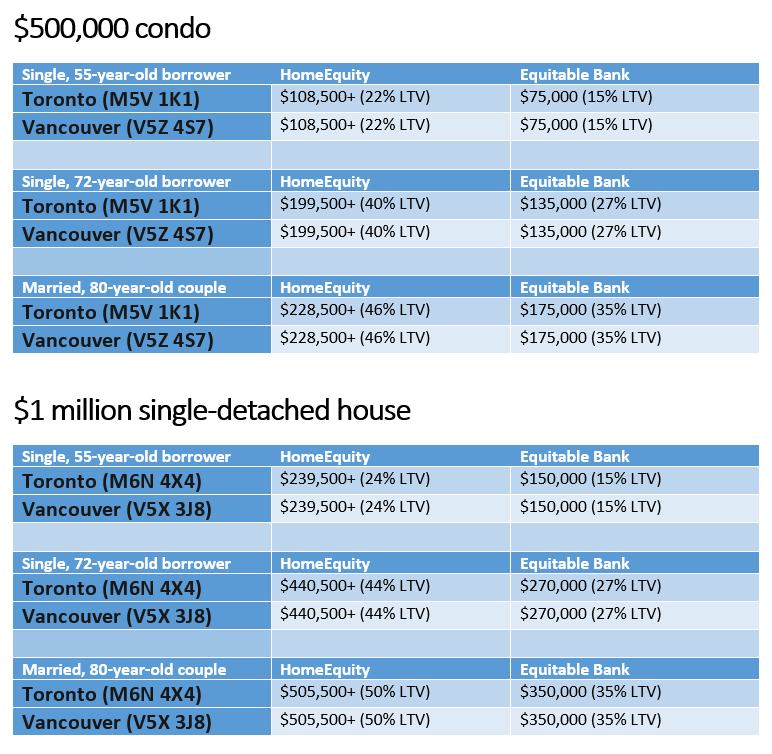

How Much Can You Borrow With A Reverse Mortgage Ratespy Com

Hecm Reverse Mortgages Current Borrowing Limits May Not Last Much Longer

Reverse Mortgage Seasoning Requirements Explained

:max_bytes(150000):strip_icc()/GettyImages-1282928304-7306b02b77bc4d48a4f3badd150ea75c.jpg)

Reverse Mortgage Requirements

What Is A Reverse Mortgage Pros And Cons Explained

Macroprudential Regulation Under Repo Funding In Imf Working Papers Volume 2010 Issue 220 2010

:max_bytes(150000):strip_icc()/FinanceofAmericaReverse-fe1b7537f6be44918be23892015edb89.jpg)

Best Reverse Mortgage Companies Of 2023

Ow8mislyku31mm

Mpa 22 06 By Key Media Issuu

What Is Reverse Mortgage How It Can Generate Income For Old People Getmoneyrich

Reverse Mortgage Net